Employers—or your accountant, bookkeeper or HR employee—set up benefits and salaries for employees and, on some platforms, contractors. For example, small businesses with under 20 employees can save money by outsourcing payroll. However, large businesses should consider investing in in-house payroll because payroll service providers can get expensive as your business grows. Depending on your budget, business size, and the expertise of your employees, you might be able to keep your payroll in-house.

- They stay up-to-date with tax laws and regulations, ensuring that your payroll processes remain compliant.

- Employees expect a pay stub that lists the gross pay and itemizes all deductions.

- You’re giving this person or vendor direct access to your business accounts and confidential employee data such as Social Security numbers, birth dates, and checking account routing numbers.

- The first few payrolls will likely be the most difficult as you walk through the process and get used to what you need to do.

- A new study from Ernst & Young reveals the true cost of payroll errors.

- By outsourcing payroll, small businesses can save money on the cost of setting up and managing their own payroll system, and then paying an employee such as a payroll specialist to manage it.

Does ADP integrate time and attendance with payroll?

Outsourcing payroll also translates to a lower risk of errors and compliance violations. Instead of juggling every law internally, you can put that concern in the hands of a true compliance expert. At the very least, outsourcing payroll lets you offload this crucial task without needing to hire your own expert with a full-time salary. A full-service payroll provider manages your payroll from start to finish – all you have to do is supply them with your business and employee data. In addition to using Paycor to automatically calculate employee tax withholdings and deductions, you can also use the Paycor payroll tax software to pay your own payroll taxes.

Issue Paychecks or Direct Deposits

Perhaps even more concerning is the increased risk of a breach of sensitive data that outsourcing inevitably brings. While many cloud-based programs for payroll data management use encrypted servers and firewalls for security, they are juicy targets for malicious activity. A company’s core business functions—whatever it does to generate revenue—are understandably its main priority.

Review and Approve Time Sheets

Consider these factors carefully to select a payroll system that meets your business’s unique needs and supports your overall goals. Professional guidance can help you navigate changes in regulations and implement best practices in your payroll system. This proactive approach minimizes risks and ensures your payroll operations run smoothly. Adopting best practices can streamline your payroll process and minimize headaches. Communicate these guidelines to your employees so they understand how their hours are tracked.

Time and Attendance

The process begins with the integration of employees into a payroll system and extends through end-of-year tax responsibilities. Since TriNet is a cloud-based solution, you don’t have to download or install it. Employers and employees can access it no matter where they are through the easy-to-use web portal or mobile app that’s available on iOS and Android devices. TriNet has an intuitive interface https://www.business-accounting.net/adjusting-entries-does-your-small-business-need/ that both employers and employees will likely find easy to navigate, even if they don’t consider themselves tech-savvy. If they do come across any questions or issues, however, the chat feature is there to help. In a move that simplifies HR headaches for businesses of all sizes, Next Generation Payroll, a champion for small businesses, has unveiled a powerful Employer of Record service.

Benefits of outsourcing payroll

In addition, if you enroll in Gusto’s Concierge plan, you can access their human resources benefits administration offerings. If you only plan to hire and pay team members in one country, it may make sense to partner with a payroll provider in that country. Clarify from the start what exactly is covered under the provider’s base fee, and what (if anything) is going to cost extra.

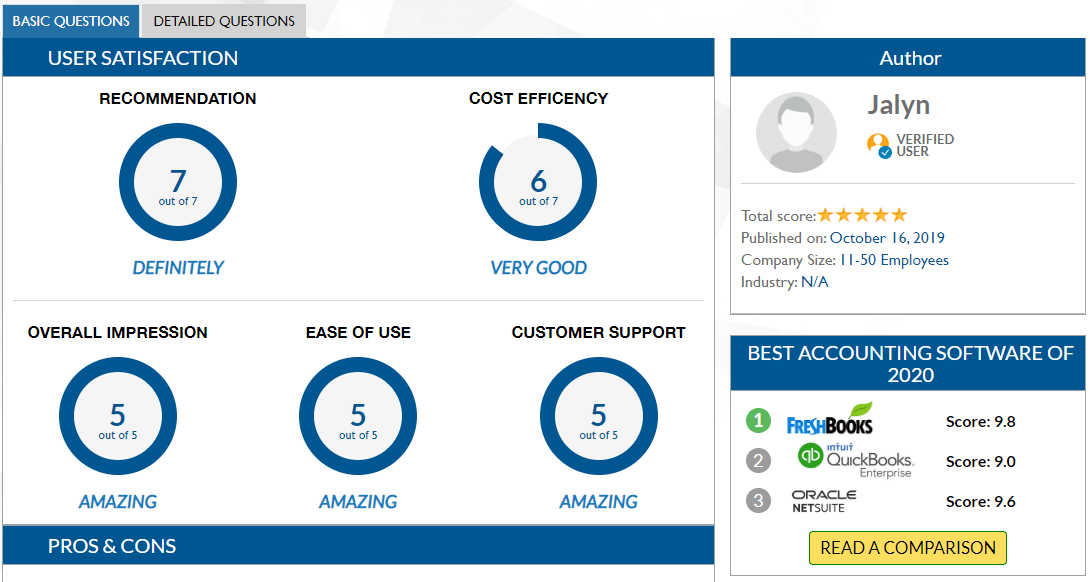

Take one or two bad reviews of the same software with a grain of salt, but if you find several with similar complaints, take caution. Vet your outsourcing partner or professional to make sure they haven’t had any legal action against them. You’re giving this person or vendor direct access to your business accounts and confidential employee data such as Social Security numbers, birth dates, and checking account routing numbers. All the benefits of outsourcing payroll are also reasons to outsource payroll.

Outsourcing payroll can save time, reduce errors, and ensure compliance for many businesses. Managing payroll in-house requires significant time and attention to detail. By outsourcing, you can delegate these tasks to professionals who specialize in payroll management. This can free up your schedule, allowing you to focus on other important aspects of running your business.

And the brand brings significant value to the table in the form of risk mitigation and contractor management. It sounds like a no-brainer, but imagine if you decide to change vendors in November. If you cancel your existing service prior to year-end, you may have trouble getting tax documents out after the first of the year. Before you change payroll services, make sure you have all of the data you need out of the old system. Besides cost, here are 13 great questions to ask when deciding to outsource payroll for small business or looking for a third-party vendor—whether a bookkeeper, payroll provider, or PEO. Small mom-and-pop businesses that need payroll and accounting integration could benefit most from working with a local bookkeeper.

Employees have the ability to clock in and out while employers can manage schedules, track projects, keep tabs on overtime and time off requests and create personalized time and attendance reports. If you’re concerned about OSHA compliance, you’ll be pleased to learn that TriNet has a claims management team that can support you with workers’ compensation and similar claims. Also, since the software prepares and files W-2s, you’ll find it easier to comply with state and federal tax regulations.

In most cases, outsourcing payroll is low risk, but there are some pitfalls you need to avoid. If you’re not careful, you could put your employees’ confidential data at risk, incur penalties and fines for noncompliance, and waste money on dividends: definition in stocks and how payments work inadequate payroll outsourcing services. A PEO is more expensive than outsourcing payroll to a bookkeeper because you get a lot more than simple payroll processing. PEOs provide HR, payroll, benefits and, often, HR consulting services.

A reliable payroll partner will provide your employees with self-service portals, which enable them to check their pay stubs, keep an eye on their benefits, and tweak their tax details if applicable. This ensures that your employees retain control over their information, and removes https://www.online-accounting.net/ the administrative burden from your HR team. Payroll providers are specialists in their field, which means it’s their job to stay on top of the latest tax laws and regulations around the globe. For a small in-house team, assembling such expertise may be an unrealistic demand.

Larger businesses or those with more complex payroll needs may benefit more from outsourcing. It can also handle benefits administration and track employee hours. Using payroll software reduces the risk of errors and saves time compared to manual methods. Establish any benefits programs that you will offer employees, such as retirement plans or health insurance. Figure out how much you will pay and how much employees will pay.

Choosing the right provider and establishing open communication channels are essential for optimal results. Now that we’ve mapped the pros and cons, let’s examine how outsourcing works. If you didn’t receive an email don’t forgot to check your spam folder, otherwise contact support. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Renowned investor Barbara Corcoran discusses the findings of a recent Forrester study showing the benefits that Paycom clients experienced. Instead, you’ll have to reach out to the company for a personalized price based on your organization and your needs.

With easy-to-use software, online payroll and tax administration can be simple. Full-service setup, payroll, and tax filing online, plus, valuable HR tools, and personal consultation to meet your business needs. Using research and writing skills from her academic background, Lauren prioritizes accuracy and delivering the best answer to the audience. She has over 13 years of writing and editing experience, including 2.5 years producing content about HR software and HR-related topics. You might need to opt for paid add-ons to ensure you have all the “must have” features in your payroll service.